Advertisement

Insurance for house owners is created to guard property possessors against different dangers, such as harm produced by unpredictable incidents like fire, storms, and destructive behavior. However, the case of mold damage could be slightly complex. The growth of mold in a residence can happen due to numerous reasons which include water leakage, excessive dampness, or inadequate airflow. This article will delve into how homeowners insurance deals with mold damage some types of water destruction might be included in specific homeowner's insurance plans, but coverage for mold destruction often has clear restrictions. What is usually provided and the ways by which homeowners can secure their properties from possible problems related to molds are also discussed.

Insurance for homeowners typically offers protection against a variety of damages that are caused by unexpected and accidental incidents. These can be fire, hail, or, damage due to pipes breaking down. If mold results from any such insured event, the insurance might provide coverage for it. Take for instance, when a storm leads to water damage and this causes mold to grow. Your homeowner's insurance might pay for both the water damage repairs and removing the mold. Nevertheless, the important point is that usually, homeowners insurance does not take care of mold caused by issues over time like insufficient upkeep or old water damage which was not immediately taken care of.

Several elements decide if mold damage will be taken care of by homeowners insurance. The main element is the cause behind the mold formation. If it happened due to a situation that your policy covers, like an unexpected roof leak or pipe burst, there are higher chances that your scheme would cover some amount for removing this mold. Nonetheless, if mold is due to negligence or poor home maintenance like a slow roof leak that was ignored for months, insurance firms may refuse coverage for the damage caused by the mold. Knowing your exact pol..icy details is very important because coverages can greatly differ among various insurers.

Normally, traditional house insurance policies do not include protection for mold caused by negligence or bad upkeep. Specifically, mold that occurs due to continuous water leaks, insufficient ventilation, or high moisture is generally not included. Insurance companies often state that damage from mold can be avoided with correct home maintenance and therefore they would not give coverage if the mold results from such avoidable situations. Homeowners might have to buy extra endorsements or riders for their policy to broaden coverage for mold damage. These additional protections could come with particular limits and conditions, so it is very important to look over the details meticulously.

If mold damage is something that worries you, it's possible to buy more coverage, particularly for fixing the issue of molds. Insurance firms are providing optional additions or extra items in your policy which can give further assurance for problems related to mold. These additional features can assist in covering expenses associated with removing mold, fixing areas damaged by it, and even temporary accommodation costs if because of a serious infestation of molds, your house becomes unfit to live in. Remember, these extra protections might require additional charges, so it's significant to evaluate if they're worth the investment considering your place and the state of your house.

If you find mold in your house, firstly understand why the mold grows. Check if it comes from a scenario that is covered like pipe bursting or water problems after a storm. If the cause of molding seems to be an event that qualifies for coverage, get in touch with your insurance firm as soon as possible so they can begin procedures related to claims. You must move fast because insurance plans frequently have deadlines for reporting claims. If the mold is caused by neglect or maintenance problems, you may end up bearing the cost of cleanup and repairs, since it's unlikely that insurance will pay for this damage.

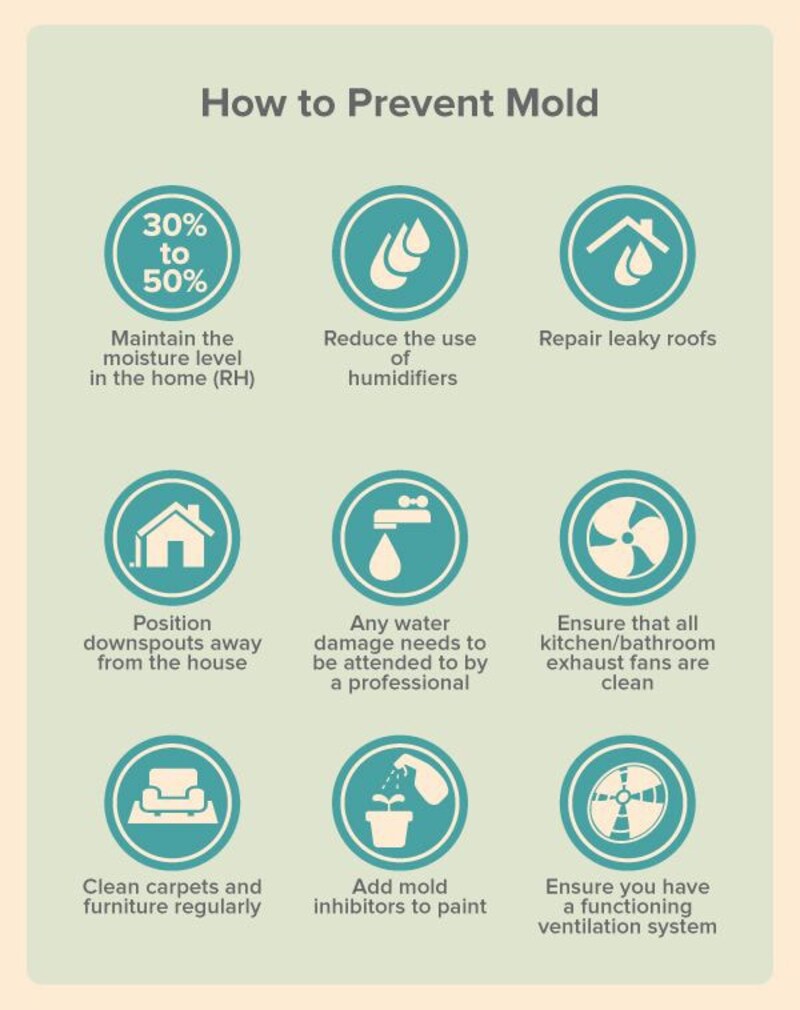

The most effective method to evade problems with mold damage and insurance complications is by being proactive in stopping the growth of mold in your house. Regularly check for water leaks at home, make sure there's appropriate ventilation, especially in places like kitchens and bathrooms, also quickly deal with any water-related damages. In certain situations, it might be beneficial to even think about setting up a dehumidifier where humidity levels are high or spending on a sump pump if you have basements that often flood. If you keep your house in good condition and handle possible problems before they get worse, it can lower the chances of mold forming. This also helps to prevent expensive fixes if insurance doesn't pay for the damage.

To wrap it all up, house insurance might include mold damage in specific cases, especially when the mold comes from sudden and unintentional incidents like pipe breaking or damages caused by storms. However, if the mold is because of neglecting it, bad upkeep, or ongoing water problems usually it's not included in coverage. Homeowners who are worried about mold should examine their policy minutely to comprehend exact conditions and think over including extra coverage for dealing with molds if required. Taking care of maintenance tasks in advance and quickly attending to problems related to water can assist you in stopping mold from growing and dodge complexity when making insurance claims. In the end, knowing your policy well and acting preventively is critical for controlling risks linked with mold in your house.

By Celia Kreitner/Dec 15, 2024

By Jennifer Redmond/Mar 16, 2025

By Georgia Vincent/Feb 28, 2025

By Tessa Rodriguez/Dec 15, 2024

By Maurice Oliver/Feb 08, 2025

By Elva Flynn/Oct 10, 2024

By Elva Flynn/Dec 07, 2024

By Sean William/Oct 14, 2024

By Aldrich Acheson/Oct 10, 2024

By Mason Garvey/Jan 03, 2025

By Madison Evans/Oct 24, 2024

By Alison Perry/Apr 01, 2025